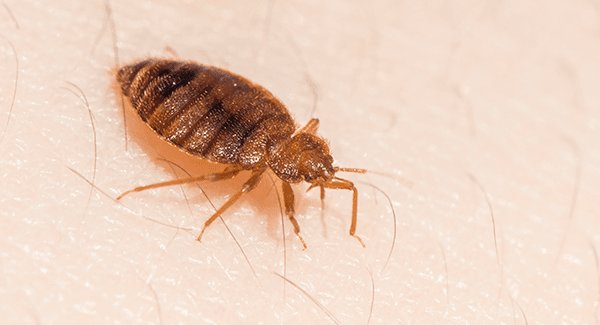

Animal incidents including biting bed bugs are a leading driver of insurance claims and losses can be significant says global insurance company allianz global corporate specialty agcs in a new report global claims review.

Bed bug insurance claim.

In order to be considered a covered loss the damage must be sudden and accidental and can t arise from home maintenance problems like infestations.

Insurance companies try to settle these claims for nuisance value by offering the claimant a small amount of money usually somewhere between 200 00 and 800 00 in exchange for the signed release of liability.

Bed bug claims can be worth a lot of money.

The proper endorsement pays up to one week s worth of lost business income as a result of the bed bug claim.

But these claims can be worth as much as 15 000 or more.

Fudge insurance offers an affordable bed bug insurance program at 2 per night which the landlord can incorporate into rental fees.

Renter s insurance like home and condo insurance covers sudden and accidental damages caused by insured perils.

The average cost for a commercial bed bug claim with allianz is almost 6 000.

Obviously if the responsible party for bed bugs is the person filing the claim then they will not be allowed to recover or will be limited in their recovery.

Bed bug insurance allows owners to deal swiftly with the problem and turn their expenses over to their insurance agent.

If you have a situation where you discover you have bed bugs you might wonder if your renter s insurance covers bed bug infestation.

Even successful hotels do not want to be out so much money if they can help it.

Why homeowners insurance doesn t cover bed bugs.

Landlords can and should acquire bed bug insurance due to the ever present threat of these parasites particularly in densely crowded housing units.

Please note the combined maximum coverage limit of extermination cost and lost business income is 15 000.

Some cases have been reported to have been settled for upwards of 300 000.

Here is what you need to know about bed bugs your insurance and what s covered or not.

Much like taking care of repairs covered under a home insurance policy for a small amount each month a property manager can set aside the worry of dealing with this costly problem should it arise.

Not only is this a short term rental industry first but we believe bed bug insurance coverage is an insurance industry first.

Homeowners insurance is financial protection if your home is damaged or destroyed by a condition that s covered by your policy.

By filing a claim the owner has the insurer pay for the costs.

Each claim is unique.

If all of these factors are determined to be sizeable and influential to your claim then you will be awarded compensation that goes well above the average bed bug lawsuit settlement.

As can be seen damages that you may recover from a bed bug bite injury will vary by case state and who the responsible party is.

Agcs analyzed more than 1 800 animal related liability insurance claims that occurred between 2011 and 2016 on which it was a named insurer either primary or excess.

Although a bed bug infestation may feel like sudden and accidental damage it is not covered by renter s insurance or by other home insurance.